XRP Price Prediction: Technical and Fundamental Analysis for 2025-2026

#XRP

- XRP trading above 20-day MA with bullish MACD momentum indicates technical strength

- Institutional adoption through ETF launches and banking infrastructure expansion supports fundamental growth

- Clear technical levels provide defined entry and exit points for risk management

XRP Price Prediction

XRP Technical Analysis

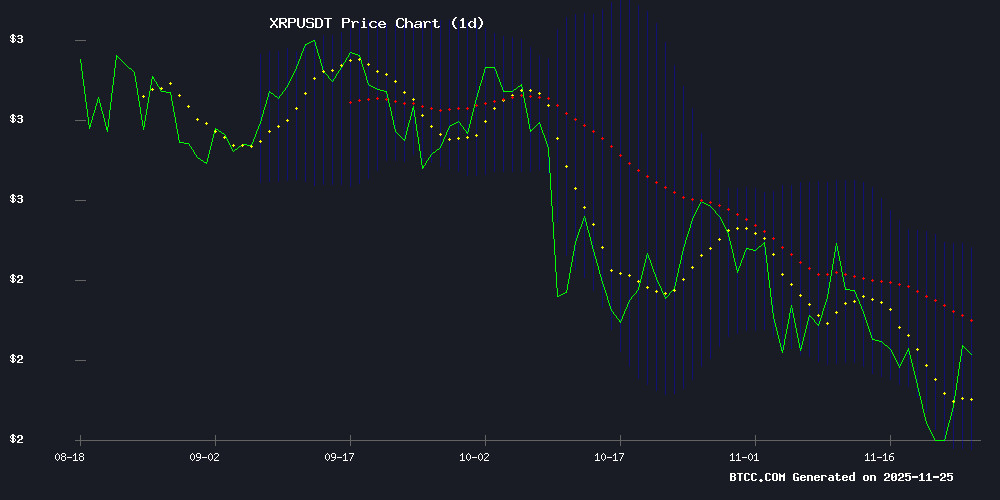

XRP is currently trading at $2.2462, slightly above its 20-day moving average of $2.2210, indicating potential bullish momentum. The MACD reading of 0.1420 versus its signal line at 0.1109 shows positive momentum, with the histogram at 0.0312 confirming upward pressure. According to BTCC financial analyst Robert, 'XRP's position NEAR the middle Bollinger Band at $2.2210, with upper resistance at $2.5164 and support at $1.9257, suggests consolidation with potential for upward movement if it can break through the $2.25 resistance level.'

XRP Market Sentiment Analysis

Recent developments surrounding XRP show strong institutional interest and growing adoption potential. Ripple's CEO forecasting institutional adoption, combined with Grayscale and Bitwise launching XRP ETF products ahead of Thanksgiving, creates positive market sentiment. BTCC financial analyst Robert notes, 'The combination of institutional product launches and Ripple's banking infrastructure expansion, particularly in markets like China, provides fundamental support for XRP's long-term growth trajectory, though technical levels should guide entry points.'

Factors Influencing XRP's Price

Ripple's Banking Ambition Emerges as CEO Foresees Institutional Adoption

Ripple's trajectory mirrors traditional finance institutions more than typical crypto ventures, according to Teucrium CEO Sal Gilbertie. The company's growing capitalization and regulated positioning could transform its role in digital asset markets.

Gilbertie highlights Ripple's unique position: 'They're incredibly well capitalized' with a machine-like operational efficiency. This financial stability reduces pressure to liquidate XRP holdings, contrasting with earlier years when token sales funded operations.

The CEO's commentary suggests XRP could evolve into a reserve asset for institutional clients, particularly if Ripple secures a formal banking license. Such development would mark a significant shift in how traditional finance interacts with cryptocurrency networks.

XRP ETFs Gain Momentum as Grayscale and Bitwise Launch Products Ahead of Thanksgiving

Institutional interest in XRP is surging as multiple exchange-traded funds debut before the Thanksgiving holiday. Grayscale's XRP Trust ETF ($GXRP) launched with zero fees, following Bitwise's recent entry into the market. Franklin Templeton may join the competition this week, signaling growing demand for regulated exposure to the world's third-largest cryptocurrency.

XRP's price shows signs of recovery, bouncing from $1.90 support to $2.05 amid the ETF announcements. A decisive break above $2.20 WOULD confirm a trend reversal after four consecutive weekly declines. Market observers note the flurry of ETF activity could mark a turning point for XRP, which powers global payment innovations.

China's Indirect Ties to XRP Through Ripple's Payment Infrastructure

China's financial ecosystem may have deeper connections to Ripple's XRP than previously understood. Versan Aljarrah of Black Swan Capitalist highlights indirect exposure through institutions like the BRICS New Development Bank and SBI Holdings, suggesting Ripple's payment rails are already facilitating cross-border transactions in regions with Chinese ties.

Ripple's infrastructure enables efficient international settlements, positioning XRP as a silent participant in key financial corridors across Asia, the Middle East, and Africa. This operational reality challenges conventional narratives about China's stance on crypto assets.

Ripple's XRP Positioned as Potential Banking Disruptor Amid Global Finance Shift

Speculation about Ripple's capacity to replace traditional banking functions using XRP has intensified following analysis by Paul Barron, founder of the Paul Barron Network. Barron argues that XRP's unique architecture positions it as a neutral settlement LAYER capable of operating without counterparties—a critical advantage in reshaping global financial infrastructure.

XRP's role as a bridge asset for high-volume transactions could streamline cross-border payments and on-chain settlements. The convergence of banking and blockchain technologies accelerates this potential, with Barron noting XRP's ability to facilitate seamless value transfer across disparate systems. "Every new stablecoin and tokenized real-world asset deployed on blockchains inherently benefits from XRP's liquidity and speed," he implied, though the report was truncated mid-argument.

Analyst Outlines Five Catalysts for XRP's Potential Surge to Triple-Digit Prices

Ripple's XRP, having scaled to a record high earlier this year after a prolonged slump, now faces a market-wide correction. Despite the downturn, Optimism persists among investors who foresee the cryptocurrency eventually eclipsing the $100 threshold. Crypto analyst Zach Humphries recently articulated five pillars that could propel XRP into triple-digit territory: real adoption, regulatory clarity, institutional integration, settlement utility, and market transformation.

XRP has already demonstrated progress across these fronts. Adoption rates have surged, while the resolution of the SEC's lawsuit against Ripple provided much-needed regulatory certainty. Institutional interest is growing, buoyed by the approval of multiple XRP ETFs. The asset's settlement functionality continues to expand, reinforcing its case for long-term value appreciation.

Is XRP a good investment?

Based on current technical indicators and market developments, XRP presents a compelling investment case with both short-term trading opportunities and long-term growth potential. The technical analysis shows XRP trading above its 20-day moving average with positive MACD momentum, suggesting near-term bullish sentiment. Fundamentally, the launch of XRP ETFs by major institutions like Grayscale and Bitwise, combined with Ripple's expanding banking infrastructure and institutional adoption forecasts, provides strong support for continued growth.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $2.2462 | Above MA |

| 20-day MA | $2.2210 | Support Level |

| MACD | 0.1420 | Bullish |

| Bollinger Upper | $2.5164 | Resistance |

| Bollinger Lower | $1.9257 | Support |

However, investors should consider the volatility inherent in cryptocurrency markets and maintain appropriate risk management strategies. The convergence of technical strength and positive fundamental developments suggests XRP could see continued appreciation, particularly if it breaks through the $2.5164 resistance level.